In tandem with compliance to the new indirect tax regulations businesses should be cognizant of other related regulations and avoid potential pitfalls when transitioning to the. They switched keywords from DIGITAL to IMPORTED SERVICES.

Malaysia Sst Sales And Service Tax A Complete Guide

Service Tax Act 2018.

. Ad Seamless POS System Integration. As you are aware the Goods and Services Tax GST Act 2014 has been repealed and the Sales and Services Tax SST legislation came into effect on 1 Sept 2018. Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try.

16112018 Finance Minister had tabled the Budget 2019 in the Parliament on the 2nd of November 2018. Service Tax Regulations 2018. GST shall be levied and charged on the taxable supply of goods and services.

GST shall be levied and charged on the taxable supply of goods and services. Malaysia Service Tax 2018. Corporate Criminal Liability could be imposed upon any corporation for any criminal act done by its employee or agent.

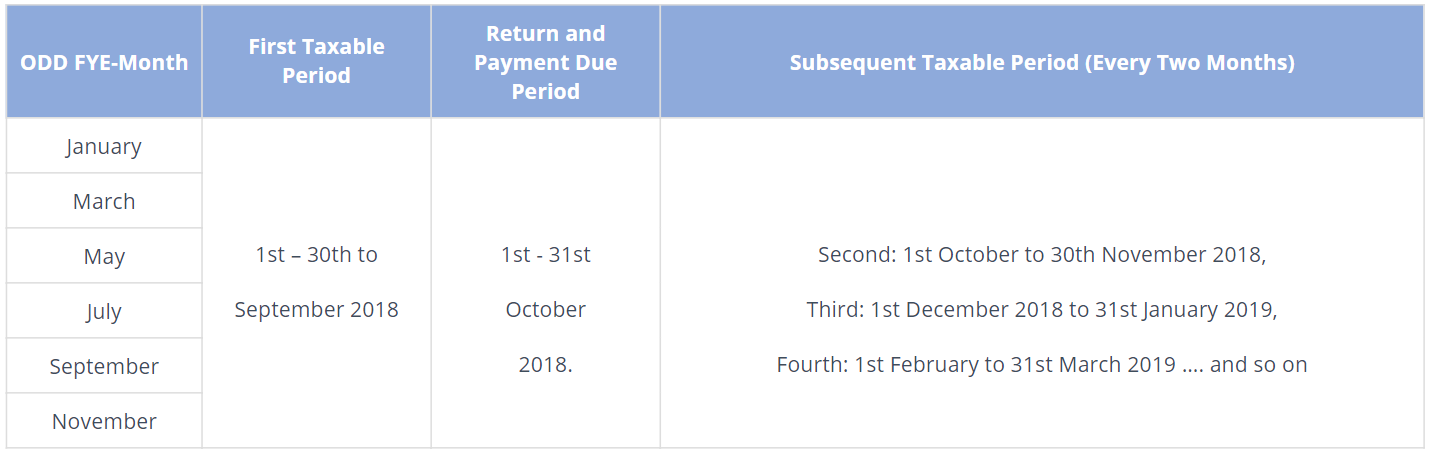

To Members of the Malaysian Bar. Question under Sales and service tax royal malaysian custom department act 2018 GTG Manufacturing Bhd registered under both Sales Tax and Service Tax Act 2018 has provided the following taxable services in its taxable period of November and December 2021 to both its subsidiaries Oriental Heat Sdn Bhd and Aqua Green Tech Sdn Bhd and another independent. The service tax will stand at 6 and it would be levied on.

DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business. It is starting 1 Jan. Service Tax Imposition Of Tax For Taxable Service In Respect Of Designated Areas And Special Areas Order 2018.

Service Tax Act 2018. Service Tax Customs Ruling Regulations 2018. The Acts provide that the provision of services will be taxed at 6 while the sale of goods will be taxed at either 5 or 10 depending on the category of.

SST Sales Tax Act 2018. Sales and service tax act 2018. The calculation for value taxable service will be Group G equal to RM600000 and Group I equals to RM300000.

Governed by the Sales Tax Act 2018 and the Service Tax Act 2018 the Sales Tax was a federal consumption tax imposed on a wide variety of goods while the Service Tax was levied on customers who consumed certain taxable services. This publication seeks to provide some basic insights of the Service Tax Act 2018 the Act. 1 Goods and Services Tax Repeal Act 2018.

Governed by the Sales Tax Act 2018 and the Service Tax Act 2018 the Sales Tax was a federal consumption tax. See Sdn Bhd provides accounting services Group G and IT services Group I. Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax.

Easy Fast Secure. Covers not just digital tax. Service Tax Regulations 2018.

Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart. Service Tax Compounding of Offences Regulations 2018. View Sales Service Tax SST_Accounting studentspdf from MANAGEMENT AEW 125 at University of Science Malaysia.

And b pay to the. The Sales Tax Act 2018. As with the Sales Tax a series of Orders is expected to be implemented as well.

The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come into effect in 1 September 2018. Section 26A1 of Service tax Act 2018 amended under Finance Act 2018. 2 Sales Tax Act 2018.

Service Tax Act 2018 Act 807Akta Cukai Perkhidmatan 2018 Akta 807 Laws of MalaysiaAuthoritative Text The Commissioner of Law. Registration for SST is required to be completed by 1 September 2018. Ad Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use.

Service Tax Customs Ruling Regulations 2018. Service Tax Compounding of Offences Regulations 2018. Sales Services Tax 2018.

In this regard the Goods and Services Tax Act 2014 has been repealed with effect from 1 September 2018. Please click on the links below to access the relevant legislation. 2018 and sales tax.

Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax. SALES AND SERVICE TAX SALES TAX SALES TAX ACT 2018 AN INDIRECT TAX IMPOSED ON CONSUMERS KNOWN AS A SINGLE STAGE TAX COLLECTED BY. According to Section 78 of the Service Tax Act 2018 and Section 93 of the Sales Tax Act 2018 the director or a person who was in any manner responsible for the management may be charged severally or jointly in the same proceedings.

It is officially IMPORTED TAXABLE SERVICE TAX 29112018 Have you heard of Imported Taxable Services Tax. The sales tax and service tax are intended to replace the goods and services tax. 26A1 Any person other than a taxable person who in carrying on his business acquires any imported taxable service shall a account for the service tax due in a declaration as may be prescribed and the declaration shall be furnished to the Director General.

The service value for accounting service is RM600000 and IT service is RM300000. Goods and Services Tax Repeal 2018 Appointment Of Date Of Coming Into Operation. See Sdn Bhd will only be liable to register for providing Group G.

The objective is not to. Service Tax Rate of Tax Order 2018. Businesses which are impacted by the new Sales Tax and Service Tax need to develop a clear roadmap to implement the necessary changes to processes and systems.

On-Time Sales Tax Filing Guaranteed. View SSTpptx from TAX 317 at Universiti Teknologi Mara. Scene 3 20s.

The sales and services tax SST took effect from 1 September 2018 replacing the goods and services tax GST. Sales and service tax act 2018. The Sales Tax and Service Tax Acts provide for the implementation of a new tax system namely the sales and service tax SST that will replace the goods and services tax GST imposed under the Goods and Services Tax Act 2014.

Following the announcement of the re-introduction of SST the Royal Malaysian Customs Department RMCD has recently announced the implementation framework of SST as well as a detailed FAQs to arm Malaysians with sufficient knowledge before SST commence.

How The Tcja Tax Law Affects Your Personal Finances

Malaysia Sst Sales And Service Tax A Complete Guide

The Environmental Assessment Act And Associated Regulations And Agreements Province Of British Columbia

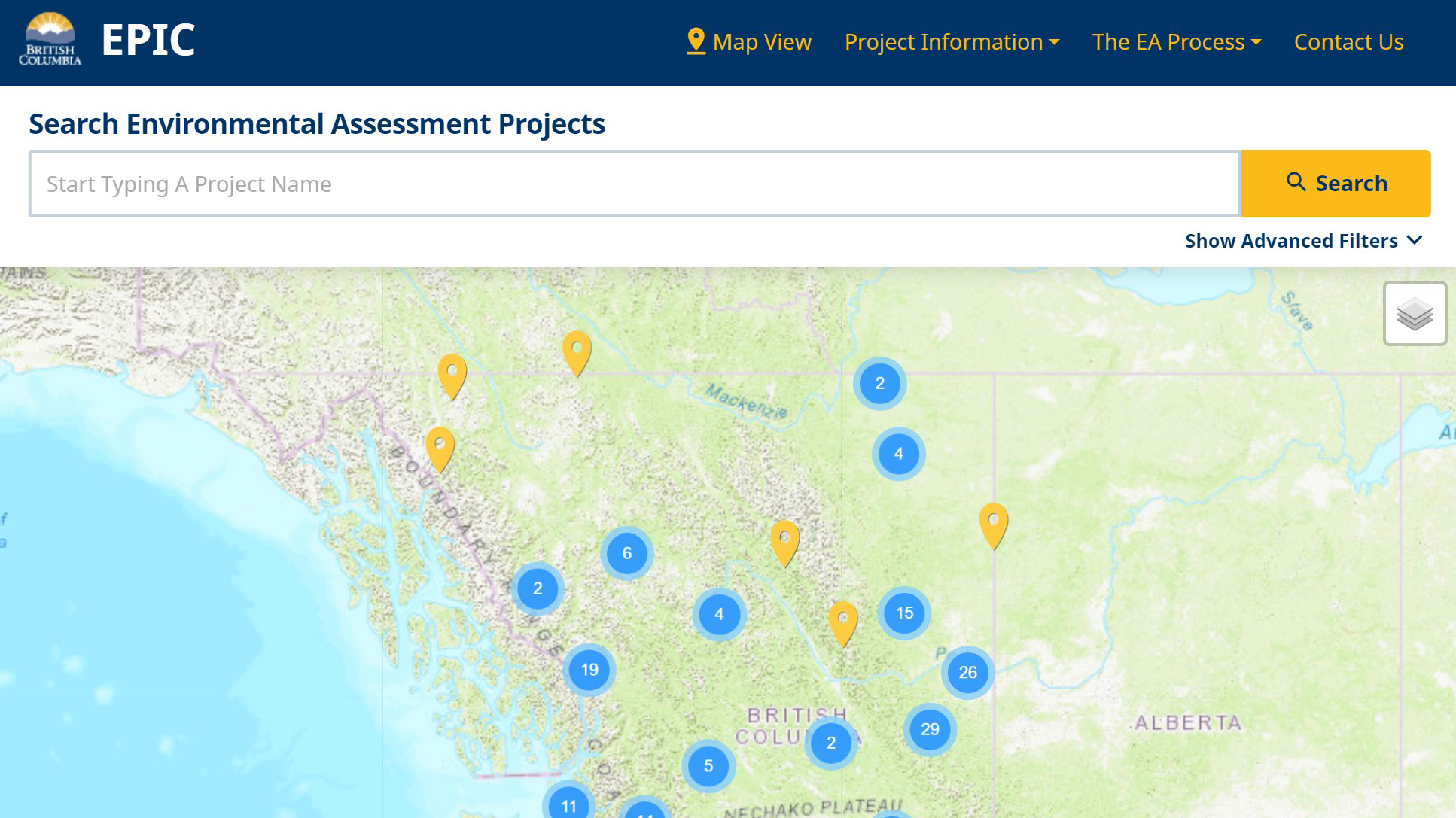

News And Announcements Related To The Environmental Assessment Process And The Environmental Assessment Office Province Of British Columbia

Taxtips Ca Business 2020 Corporate Income Tax Rates

Dividend Gross Up And A Dividend Tax Credit Mechanism

The Environmental Assessment Act And Associated Regulations And Agreements Province Of British Columbia

How The Tcja Tax Law Affects Your Personal Finances

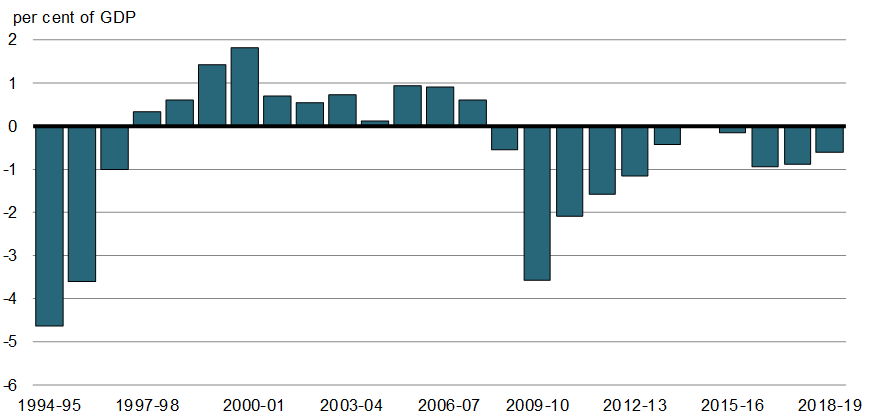

Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca

How The Tcja Tax Law Affects Your Personal Finances

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Application Requirements For Cannabis Cultivation Processing And Medical Sales Licences Canada Ca

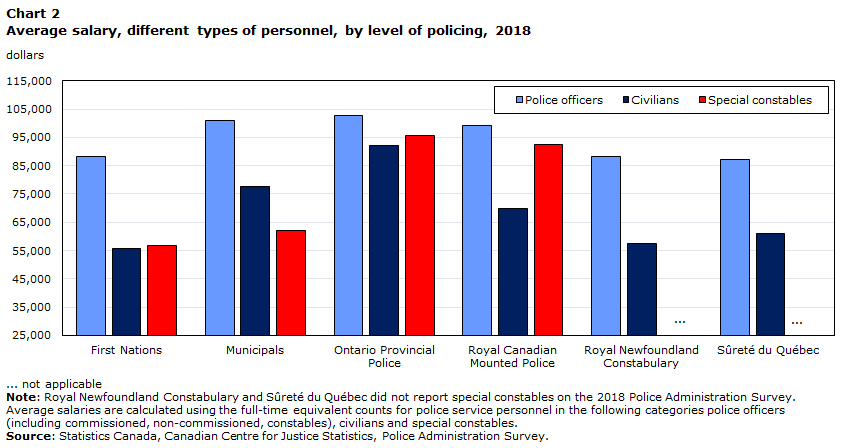

Police Resources In Canada 2018